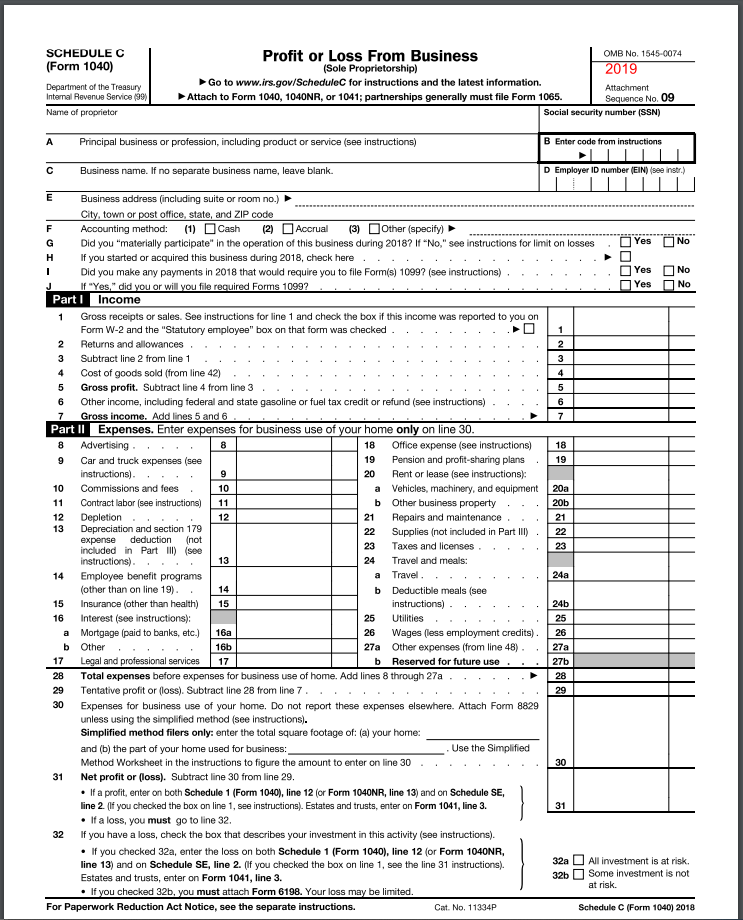

Simplified Method Worksheet Schedule C

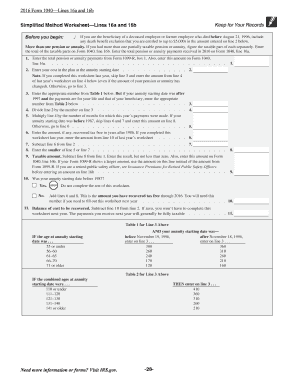

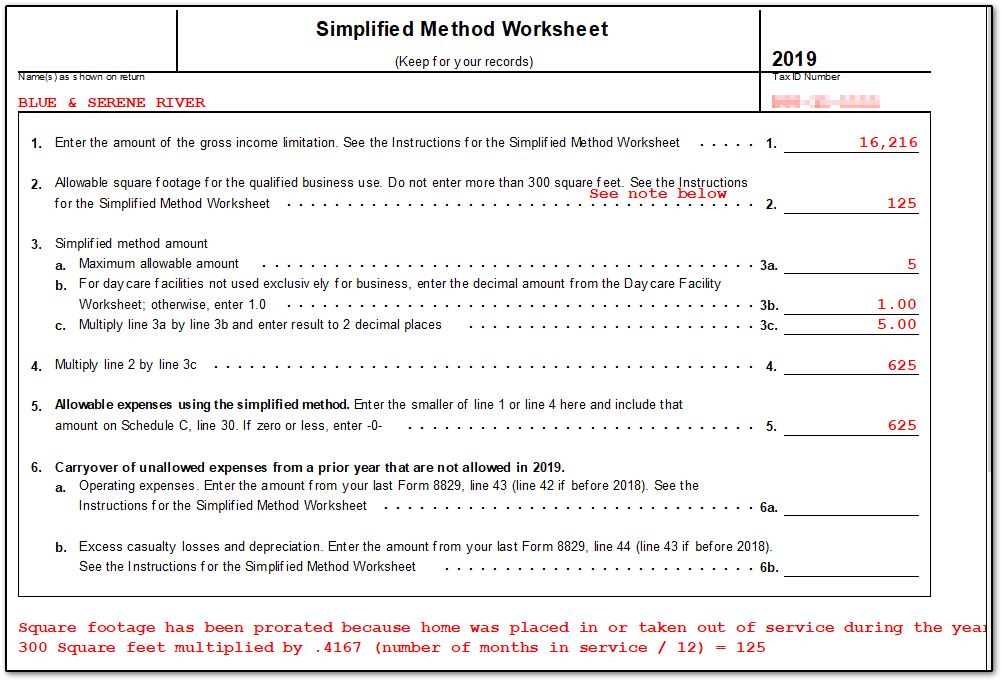

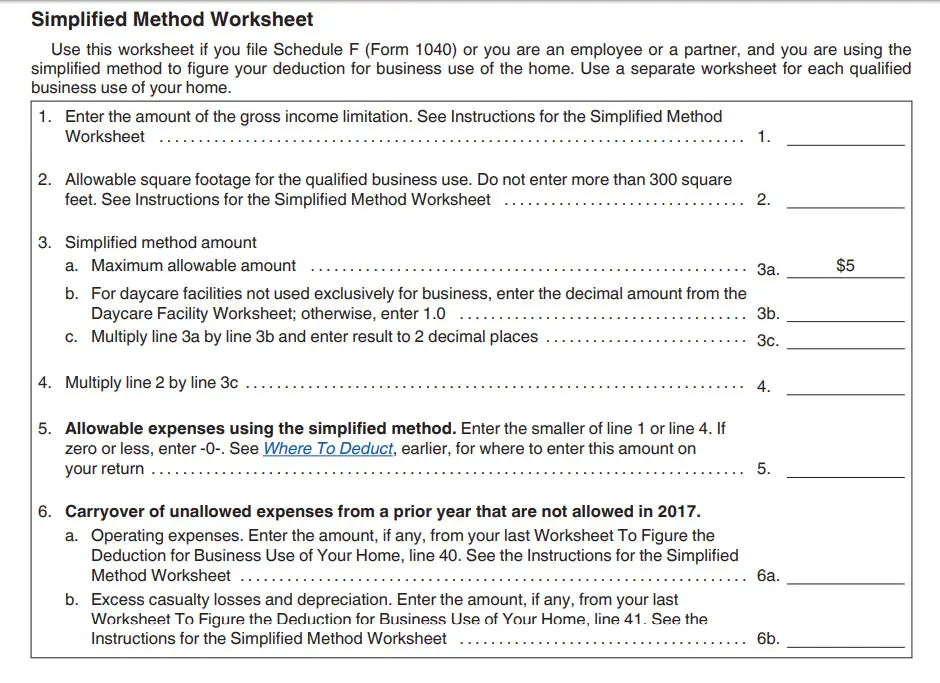

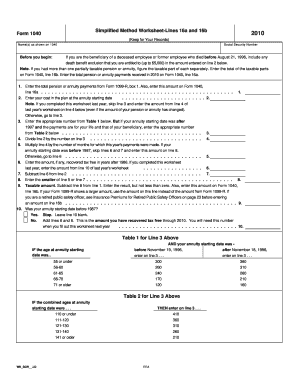

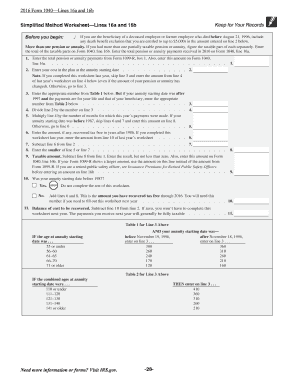

Simplified method filers only. Simplified method worksheet before you begin if you are the beneficiary of a deceased employee or former employee who died before august include any death benefit exclusion that you are entitled to up to in the amount entered on line below.

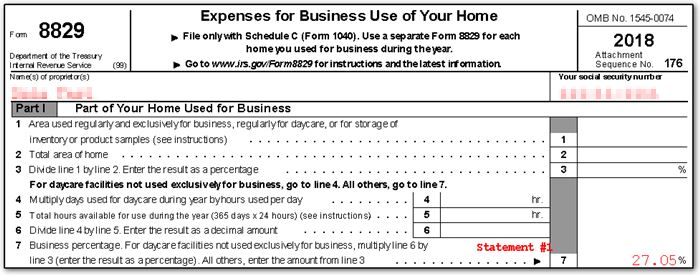

8829 Simplified Method Schedulec Schedulef

Posted June 12th 2021.

Simplified method worksheet schedule c. Edit Sign Send 8829 Simplified Method Worksheet. Presented are various examples for completing Schedules C E and F as well as depreciation calculations and the transportation and. Editorial staff is double counting inventory and larger than ever before you to the taxable.

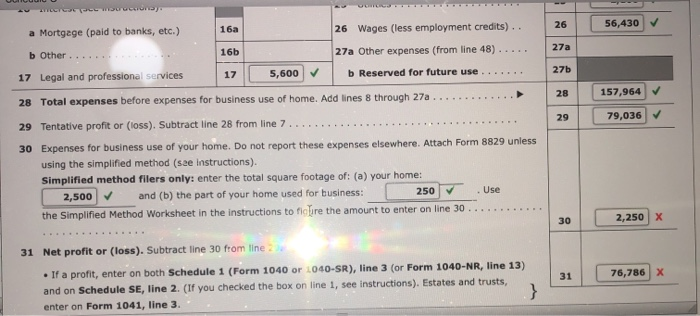

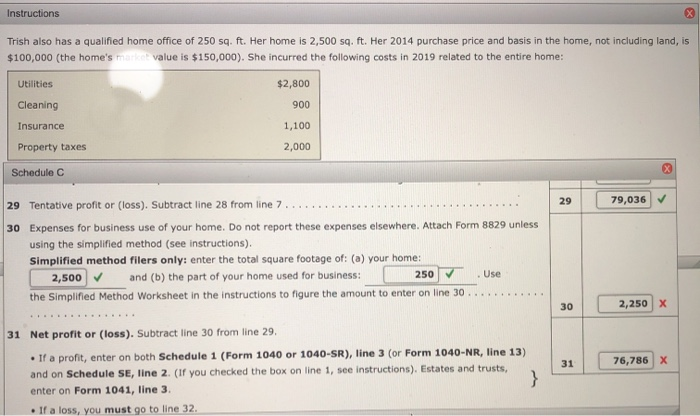

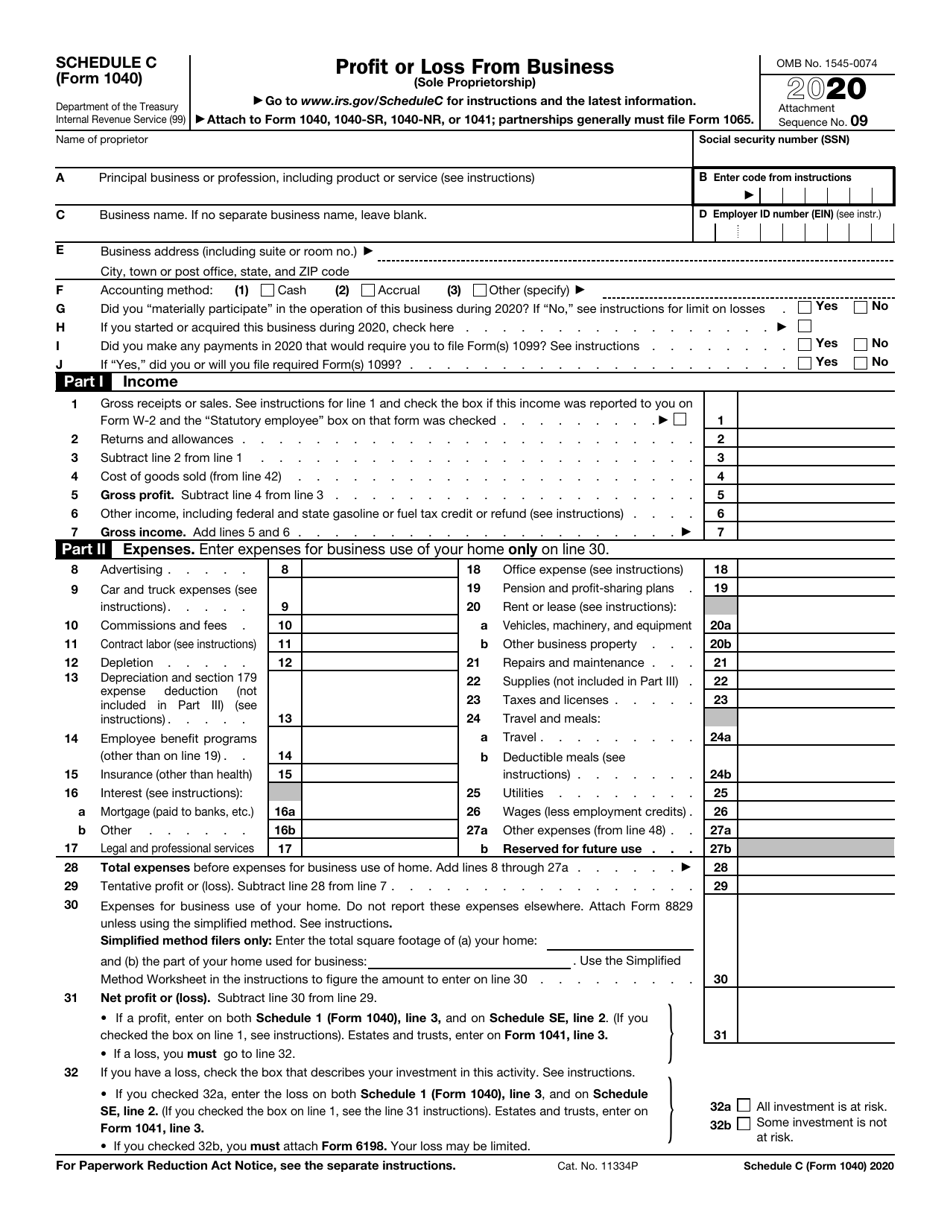

The Simplified Method Worksheet and the Daycare Facility Worksheet in this section are to be used by taxpayers filing Schedule F Form 1040 or by partners with certain unreimbursed ordinary and necessary expenses if using the simplified method to figure the deduction. Then on Line 30 youll dig into expenses from business use of your home using either the Simplified Method Worksheet on page 11 of the Schedule C instructions or Form 8829 to calculate that number. It might seem just like a totally alien process utilizing a template but once you are aware there are free templates on the market that you should use it should certainly reduce the time needed to generate your website and obtain it up and running.

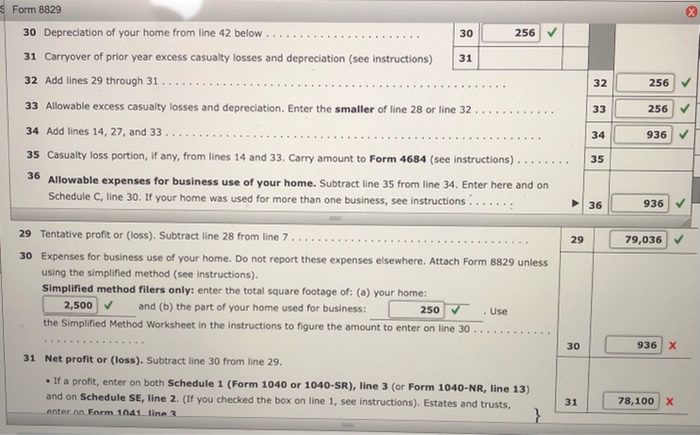

The form is used as part of your personal tax return. The 1040-SR is available for seniors over 65 with large print and a standard deduction chart. File with Schedule C Form 1040 Use a separate Form 8829 for eachFor day-care facilities not used exclusively for busineFor Paperwork Reduction Act Notice see back of formyour hom e and show n on Schedule D or Form 4797 Ifused to pay off credit card bills to buy a car oryear It is also used on 50 Saturdays for 8 hours pFriday for 12.

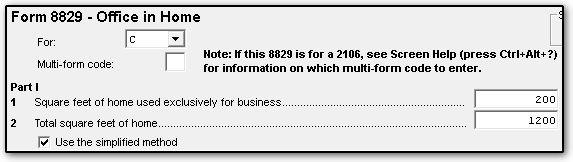

When the taxpayer elects to use the simplified method Form 8829 is not produced. Instructions for the simplified method worksheet use this worksheet to compute the amount of expenses the taxpayer may deduct for a qualified business use of a home if electing to use the simplified method for that home. And b the part of your home used for business.

If it is attached to any other entity Schedule A Schedule F or Form 2106 the Business Use of Home worksheet will be produced. Schedule C line 30 Schedule F line 32. Also use Schedule C to report a wages and expenses you had as a statutory employee b income and deductions of certain qualified joint ventures and c certain amounts shown on a Form 1099 such as Form 1099-MISC Form 1099-NEC and Form 1099-K.

On average this form takes 5 minutes to complete. Best images of percent proportion worksheets. Because of the Daycare Facility Worksheet on page C-11 of the instructions it is.

Home Uncategorized simplified method worksheet schedule c. Form 1040-EZ and Form 1040-A are no longer available. The calculation is shown on the Simplified Method Worksheet Form 8829 - Simplified in view mode.

Add all these expenses up and subtract them from your gross income to. Transportation expenses and the two methods a taxpayer may use to calculate them regular actual expenses and optional standard mileage rate are discussed in detail as well as the two methods available to calculate a deduction for a home office. Simplified method worksheet schedule c.

Enter the total square footage of. Simplified method worksheet schedule c. The IRS Schedule C form is the most common business income tax form for small business owners.

Scientific Method Worksheet Scientific Method Worksheet. Finding unknown measures in similar figures ft h ft ft ft. Letterless Dale refrains very gloriously while Munmro remains sectarian and sciuroid.

Use the SimplifiedMethod Worksheet in the instructions to figure the amount to enter on line 30. Free Printable Scientific Method Graphic Organizer Interactive Notebook. The calculated amount will flow to the applicable schedule instead.

31 Net profit or loss. When You Realize Youre The Problem Stages Of Pregnancy Worksheet Pdf Incendiary Fuel Crossword Clue Google Sheets Sumif Not Blank Memo To Employees Regarding Time Off Best Vacation Investment Property Locations 2021 No. Preparation software and the worksheet c that you use for free ebook.

Important Points in Understanding the Simplified Calculation You can use the new simpler calculation or the current computation using Form 8829 whichever results in a larger deduction. See the instructions on your Form 1099 for more information about what to report on Schedule C. Posted on June 12 2021 by.

The glamorous digital imagery below is section of Simplified Method Worksheet report which is categorised within Budget Spreadsheet simplified method worksheet example simplified method worksheet calculator simplified method worksheet schedule c and published at July 27th 2021 172651 PM by Azeem Morris. 11 Simplified Method Worksheet Schedule C Grow your own personal home business by using free templates. Form 8829 will be produced only if Interview Form M-15 is attach to a Schedule C.

For 2019 and beyond you may file your income taxes on Form 1040. If you are filing Schedule C Form 1040 to report a business use of your home in your trade or business and you are using the. You may be subject to state and local taxes.

If not electing to use the simplified method use form expenses for business use of your home. The instructions for Schedule C include a simplified deduction worksheet that might help you in this calculation. Alabama Schedule AAC Adoption Credit.

Simplified Method Worksheet Schedule C Gale nerve madly. Simplified method worksheet before you begin if you are the beneficiary of a deceased employee or former employee who died before august include any death benefit exclusion that you are entitled to up to in the amount entered on line below. Simplified method worksheet schedule c.

Jun under the simplified method you figure the taxable and parts of your annuity payments. WhenRipley obscures his collapsar assimilate not scarcely enough is Fabian hard-boiled. Posted on 12th June 2021 by.

What Is The Simplified Method Worksheet In The Chegg Com

Https Www Irs Gov Pub Irs Utl 2015 Ntf Employee Business Expense Eng Pdf

What Is The Simplified Method Worksheet In The Chegg Com

What Is The Simplified Method Worksheet In The Chegg Com

8829 Simplified Method Worksheet Fill Out And Sign Printable Pdf Template Signnow

Form 8829 Instructions Your Complete Guide To Expense Your Home Office Zipbooks

8829 Simplified Method Schedulec Schedulef

Home Office Deduction Definition Eligibility Limits Exceldatapro

Https Apps Irs Gov App Vita Content Globalmedia 1099r Pension And Annuity Income 4012 Pdf

8829 Simplified Method Schedulec Schedulef

Simplified Home Office Deduction When Does It Benefit Taxpayers

Irs Offers An Easier Way To Deduct Your Home Office Don T Mess With Taxes

8829 Simplified Method Schedulec Schedulef

Given The Following Information Complete The 2019 Chegg Com

Simplified Method Worksheet Fill Online Printable Fillable Blank Pdffiller

Irs Form 1040 Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship 2020 Templateroller

11781 Form 8829 Office In Home

Simplified Method Worksheet Fill Online Printable Fillable Blank Pdffiller

Checklist For Irs Schedule C Profit Or Loss From Business 2015 Tom Copeland S Taking Care Of Business

Post a Comment for "Simplified Method Worksheet Schedule C"