Best Self Employed Income Calculation Worksheet

For employment and other types of income check out our Income Analysis worksheet. See Part II Section 6 7 DividendsInterest.

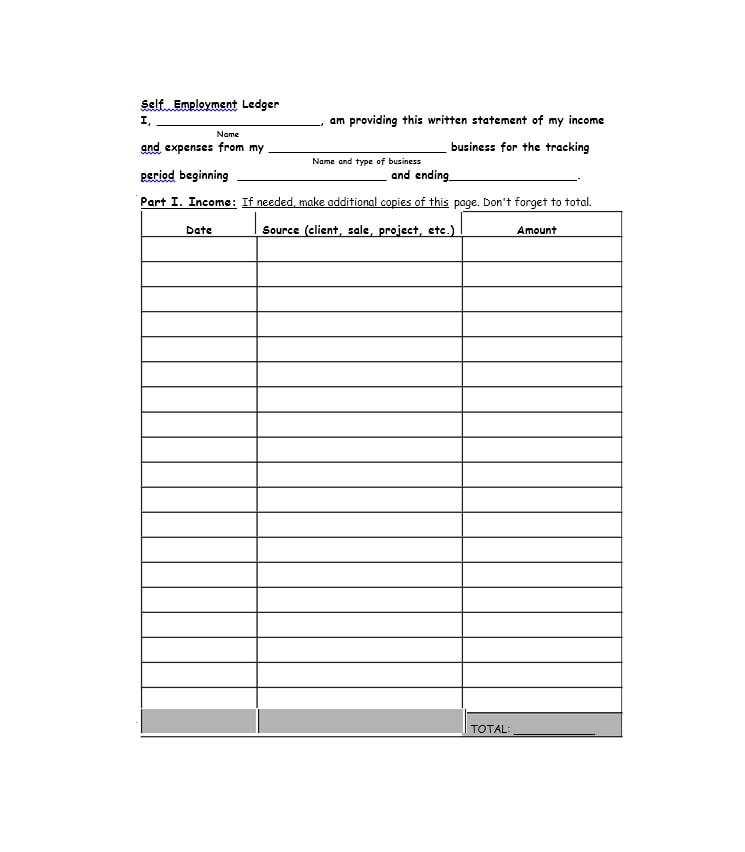

Self Employment Ledger 40 Free Templates Examples

Full instructions on using the cash book template are available here.

Best self employed income calculation worksheet. See Part II Section 3 4 Semi-Monthly. See Part II Section 2 3 Bi-Weekly. Fannie Mae Form 1084 Calculator 2019-2020.

We get it mental math is hard. Calculator and Quick Reference Guide. Dividends from Self.

Fannie Mae Cash Flow Analysis. Please note that these tools offer suggested guidance they dont replace instructions or. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you.

Thats why Enact provides a collection of downloadable calculators and reference guides to help you analyze a self-employed borrowers average monthly income and expenses. Analyze self-employed borrower cash flow income from employment and non-employment sources and rental income using our editable auto-calculating worksheetsCash flow analysis worksheets tax year 2020 Self-employed SAM Cash Flow Analysis with PL 02192021 Download the worksheet. See Part II Section 1a 1b 1c or 1d seasonal worker 2 Weekly.

Underwriter Comments Base Used to Qualify Total Income to Qualify Monthly Avg Break out OTBonus from base salary or check the income you wish to use check the salary you wish to use Total Non. The self employed bookkeeping template runs from April to March. This form is only a reference to help organize information from the tax returns You must refer to the FNMA selling guide for compThis form is only a reference to help organize information from the tax returns You must refer to the FNMA selling guide for competc Schedule K-1 for filing federal income tax returns for the partnership The.

It is best to use a separate worksheet for each person whose income needs to be calculated. If your accounting period is 6 th April to 5 th April the best advice is to add the end of the year April figures into March. Self Employed Bookkeeping Template.

A new worksheet will need to be used for. Think about ways that you are able to spend less. Who have 25 or greater interest in a business.

Business Stability and Income Worksheet 2021 Created as result of changes made by the. Who are employed by family members. Even for household cleaning goods and such you are able to do the specific same and save a significant amount of money.

Our editable auto-calculating worksheets help you to analyze. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. Our cash flow analysis worksheets help you to easily and accurately determine a self-employed borrowers income.

Thats why weve developed several self-employed borrower calculators to help you calculate and analyze their assets properly. How annual income is calculated under the Federal Guidelines. This form does not replace the requirements and guidance for the.

Income Calculation Worksheet YTD Salary paytsub Past year OT breakout use lowest income average Date W2 for Tax Year. The FHA Self-Employment Income Calculation Worksheet which is located at. When you creating a business budget you also need to count the amount of.

Fill Out the Self Employed Income Worksheet Form. Unlike installment credit which gives you a fixed sum of money plus a repayment schedule above a predetermined amount of period revolving credit is open-ended. Schedule B Interest and Ordinary Dividends a.

It keeps checking the bank figure much easier. IRS Form 1040 Individual Income Tax Return. Keep Your Career On The Right Track Our income analysis tools are designed to help you evaluate qualifying income quickly and easily.

See Part II Section 7. Self-employed Income Calculation Worksheet. Cash flow and YTD profit and loss P.

Under Forms FHA is a tool to be used for FHA loans when any borrower is self -employed. You will spare a package if you maintain certain appliances. See Part II Section 4 5 OvertimeBonuses.

Self-Employment Income Calculation Worksheets images similar and related articles aggregated throughout the Internet. Cash Flow Analysis This self-employed income analysis and the included descriptions generally apply to individuals. When you try to put together a business budget you will also need to include amounts cost which have to pay towards Tax National Insurance.

Determining a self-employed borrowers income isnt always straightforward. Self-Employed Borrower Tools by Enact MI. IRS Form 1040 Individual Income Tax Return Year_____ Year_____ 1.

As a general rule to calculate income for child support you must identify the updated amounts related to the sources of income used to calculate your Total income on line 15000 150 for 2018 and prior years of the T1. Interest Income from Self-Employment Line 1 b. 2 years personal tax returns with all schedules 1099s.

The worksheet is to be used for evaluation of only one self -employment business per borrower. The best way to work out what available to pay your personal household costs is try to create a business budget. Radians Self-Employed Cash Flow Analysis Calculator is designed to assist you in underwriting loan applications from self-employed borrowers for coverage with Radian mortgage insurance.

W-2 Income from Self-Employment Only add back the eligible Other deductions such as Amortization or Casualty Loss. Income Calculation Worksheet Self Employed. A typical profit and loss statement has a format Continue Reading.

See Part II Section 5a or 5b 6 Commissioned. This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. INCOME CALCULATION WORKSHEET PART I - INCOME TYPE Section Borrower Co-Borrower 1 Hourly.

Form 91 is to be used to document the Sellers calculation of the income for a self-employed Borrower. YTD Avg using net income YTD 1 year using Net Income W2 for year. W-2 Income from Self-Employment.

Self-Employed borrower cash flow analysis worksheets. This form is a tool to help the Seller calculate the income for a self-employed Borrower. 1000 x25 1250 section 14.

The Sellers calculations must be based on the requirements and guidance for the determination of stable monthly income in Topic 5300.

Self Employment Tax Calculator For 2020 Good Money Sense Self Employment Money Sense Income Tax Preparation

Small Business Tax Spreadsheet Business Worksheet Business Tax Deductions Business Budget Template

Fannie Mae Income Calculation Worksheet Fill Online Printable Fillable Blank Pdffiller

Https New Content Mortgageinsurance Genworth Com Documents Training Course Review 20s Corporation 20tax 20return 20form 201120s 20and 201040 20with 20w2 20and 20k1 Pdf

Profit And Loss Statement For Self Employed Template Business Balance Sheet Balance Sheet Template Financial Statement

Will You Have A Side Hustle In 2017 Be Self Employed Or Earn Money Freelancing You Ll Need To Know All About Quarterly Taxes Business Tax Small Business Tax

The Business Spreadsheet Template For Self Employed Accounting Amp Taxes Amp Llcs Youtube Spreadsheet Template Business Finance Spreadsheet

Simple Spreadsheets To Keep Track Of Business Income And Expenses For Tax Time All About Planners Business Tax Deductions Spreadsheet Business Business Tax

Icici Bank Q1 Fy2019 20 Result Review And Analysis Icici Bank Growth Marketing Investing

Free Business Income And Expense Tracker Worksheet Small Business Expenses Business Budget Template Spreadsheet Business

10 Self Employment Ledger Samples Templates In Pdf

Https New Content Mortgageinsurance Genworth Com Documents Training Course Seb1084 Pt1 Presentation 0719 Pdf

Self Employed Expenses Worksheet Promotiontablecovers

Proving Income When Self Employed Fill Online Printable Fillable Blank Pdffiller

Self Employed Income Worksheet Fill Out And Sign Printable Pdf Template Signnow

![]()

Free Business Income And Expense Worksheet Printable Business Expense Tracker Expense Tracker Small Business Expenses

Accounting And Recordkeeping Made Easy For The Self Employed Accounting Business Tax Business Advice

Post a Comment for "Best Self Employed Income Calculation Worksheet"