How To Calculate Ppp Loan Forgiveness For Self Employed

Service must have been established prior to 2152020 Limited to the extent it was claimed or entitled to be claimed on 2019 Schedule C. To find your average monthly payroll expense take your gross income up to.

Ppp Loan Forgiveness For The Self Employed Independent Contractors And Sole Proprietors Youtube

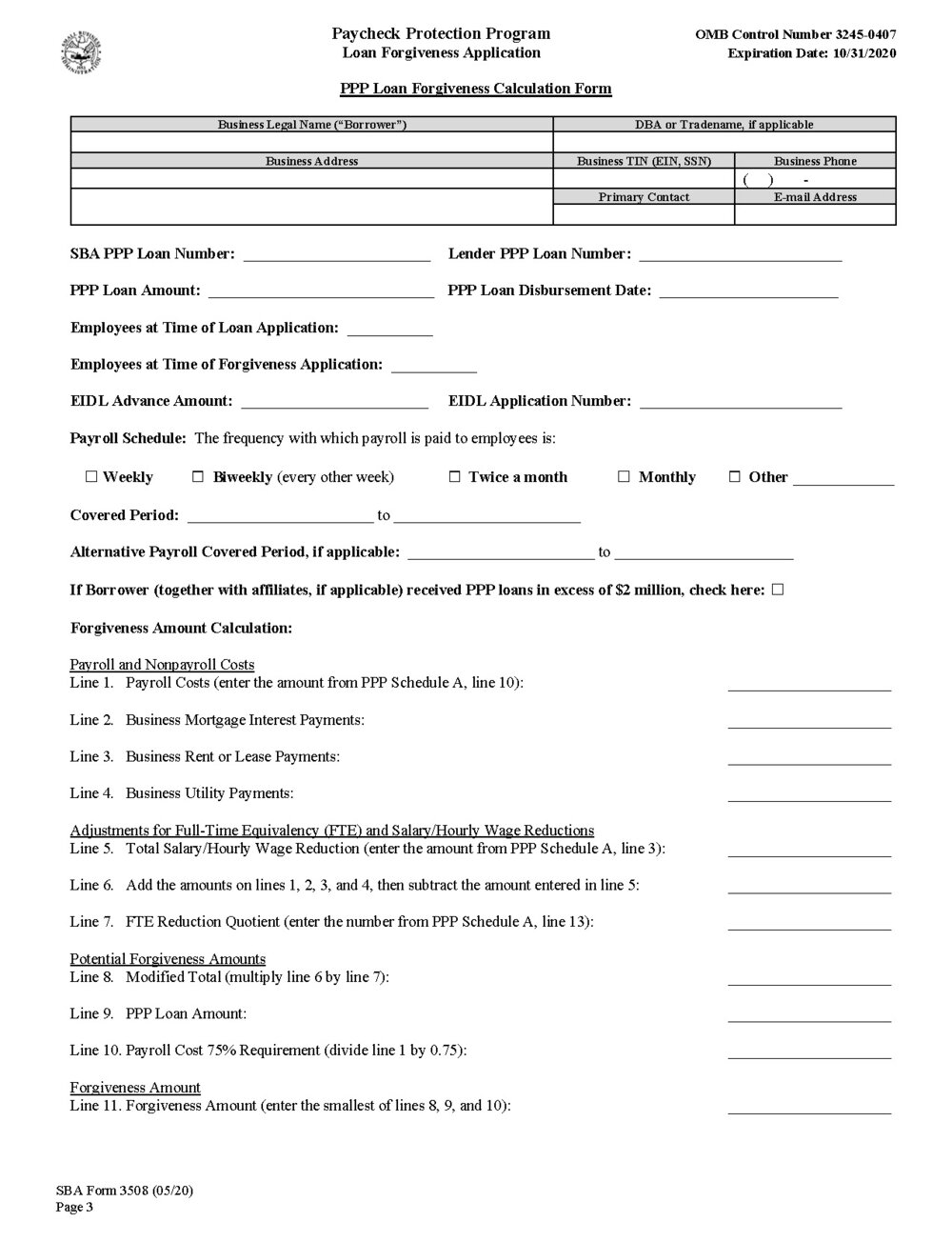

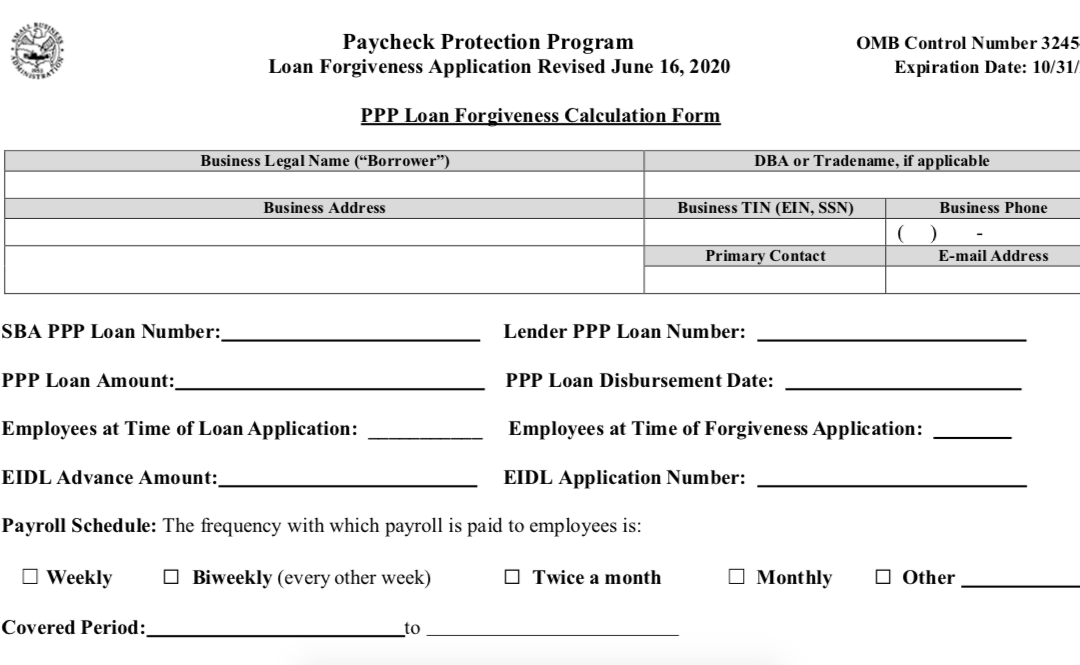

First Draw PPP loans made to eligible borrowers qualify for full loan forgiveness if during the 8- to 24-week covered period following loan disbursement.

How to calculate ppp loan forgiveness for self employed. For the self-employed the PPP loan amount is based on their 2019 monthly average net profit which is calculated by taking their net profit for the year and dividing it by 12. When calculating the amount of forgiveness the cash compensation per employee is capped at an annualized salary 100000 prorated based on the number of weeks in Covered Period. Wait time between First and Second Draw PPP If you got your first round of PPP in 2021 check here to see if enough time has passed for you to apply for the second round of PPP.

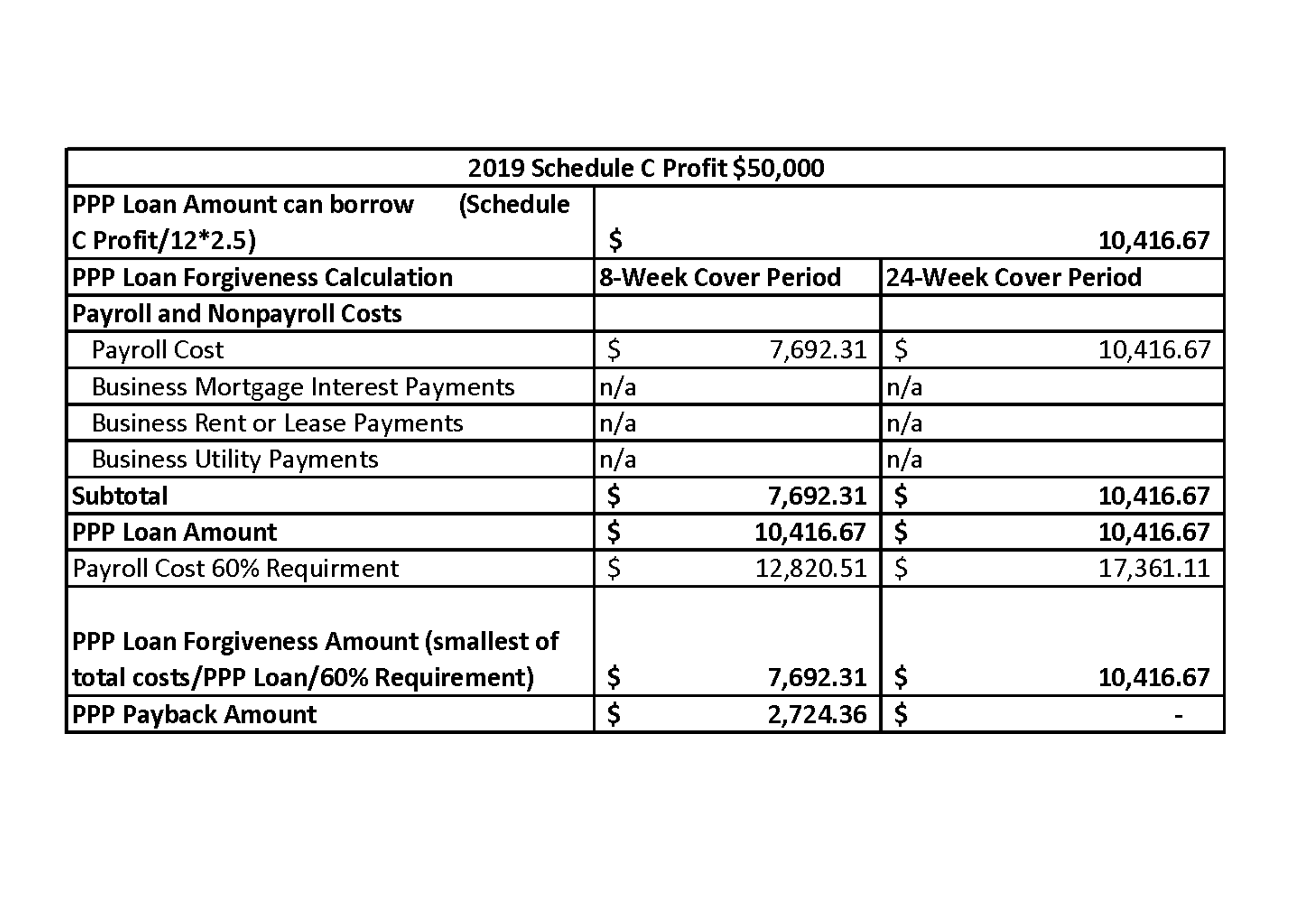

If you need help figuring out your maximum loan. Divide your 2019 Schedule C line 31 net profit up to 100000 by 12 to calculate average monthly payroll costs used in the loan amount calculations. As self-employed individuals who received a Paycheck Protection Program PPP loan look forward to maximizing their loan forgiveness the following outlines the steps to take to calculate the amount of the PPP loan eligible for forgiveness.

Under the PPP Flexibility Act you can also calculate your maximum loan based on eight weeks of compensation up to 15385. PPP Loan Forgiveness for Self EmployedI talk about the PPP loan forgiveness for self employed individuals in this video. The 3508S is great because it requires fewer calculations and less documentation.

As of 03032021 you can calculate your PPP based on either gross income line 7 or net income line 31. Self-employed PPP loan forgiveness. If that amount is more than 100000 reduce it to 100000 more than this is not allowed for an annual salary amount under the PPP loan.

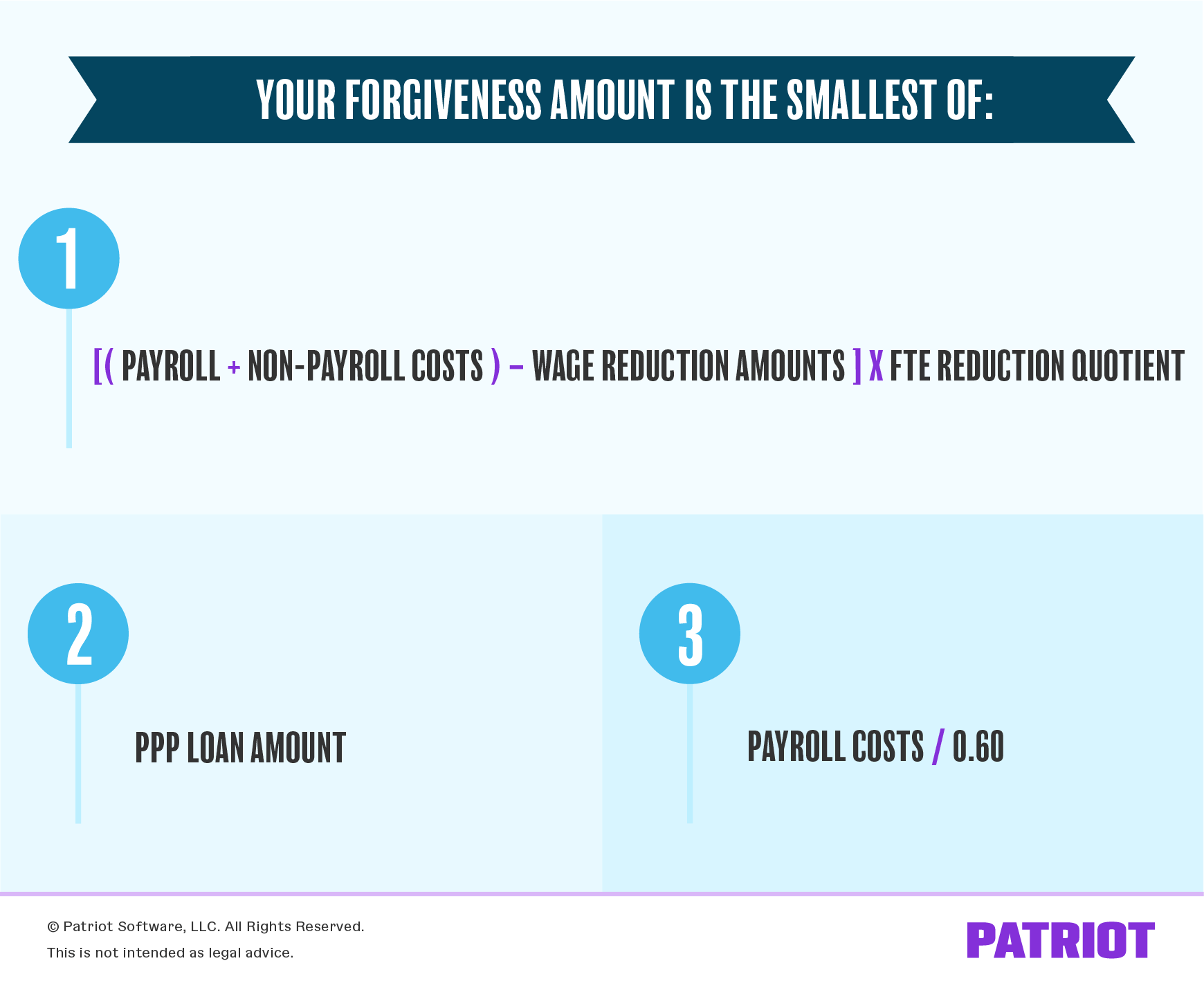

These FAQs are for informational purposes only are general in nature and should not be relied upon or construed as a legal opinion or legal advice. So you would use this form if your PPP loan amount was 150000 or less. I mostly cover the payroll porti.

If both your net profit and gross income are zero or less you are not eligible for a PPP loan. 68 percent of all self-employed loan applications fell into this bucket. And If the Borrower has elected an 8-week Covered Period for any owner-employee or self-employed individualgeneral partner salary.

Sole proprietors without payroll costs If you arent running payroll your PPP loan amount will be calculated using your gross income as reported on line 7 of a 2019 or 2020 Schedule C. The forgiveness amount you are requesting Self-employed individuals can take the entire PPP loan amount as owner compensation replacement so long as you use a covered period of 24 weeks. For example for an 8-week Covered Period the maximum forgiveness is calculated as 100000.

Calculate your average monthly profit Take the amount you gathered in Step 1 and divide it by 12. If a 24-week Covered Period applies for any owner-employee or self-employed individualgeneral partner salary is capped at 20833 per individual. Employee and compensation levels are maintained The loan proceeds are spent on payroll costs and other eligible expenses.

Look over these steps now to prepare for maximum loan forgiveness at the end of the covered period. PPP 2 Daily Update for Self Employed. However as a self-employed worker you can claim all 100 of your PPP loan as.

The new guidance does not appear to allow health insurance premiums or retirement benefits paid for sole proprietors to be added to. All you have to do is divide your 2019 net profit by 52 and then multiply by eight. And At least 60 of the proceeds are spent on payroll costs.

This means you can put the full loan amount as both your payroll expense and the amount youre requesting forgiveness on. PPP Loans Self Employed. For a covered period longer than 25 months the amount of loan forgiveness requested for owner-employees and self-employed individuals payroll compensation is capped at 25 months worth 2512 of 2019 or 2020 compensation up to 20833 in total across all businesses.

The 6040 rule states that 60 of your PPP loan must be used on payroll costs and the remaining 40 can be used on other eligible expenses rent mortgage interest utilities etc. How to apply get PPP. PPP Self-Employed Loan Forgiveness As of 6102020 Utilities Includes payment for electricity gas water transportation telephone or internet access.

PPP Loan Forgiveness for the Self-Employed Frequently Asked Questions This calculator estimates forgiveness for self-employed individuals who file Schedule C and have no employees. If you are self-employed your net profit amount should be listed on your Form 1040 Schedule C for 2019.

How To Get Your Ppp Loan Forgiven Self Employed Youtube

A Guide To Ppp Loan Forgiveness For The Self Employed Funding Circle

How To Calculate Gross Income For The Ppp Bench Accounting

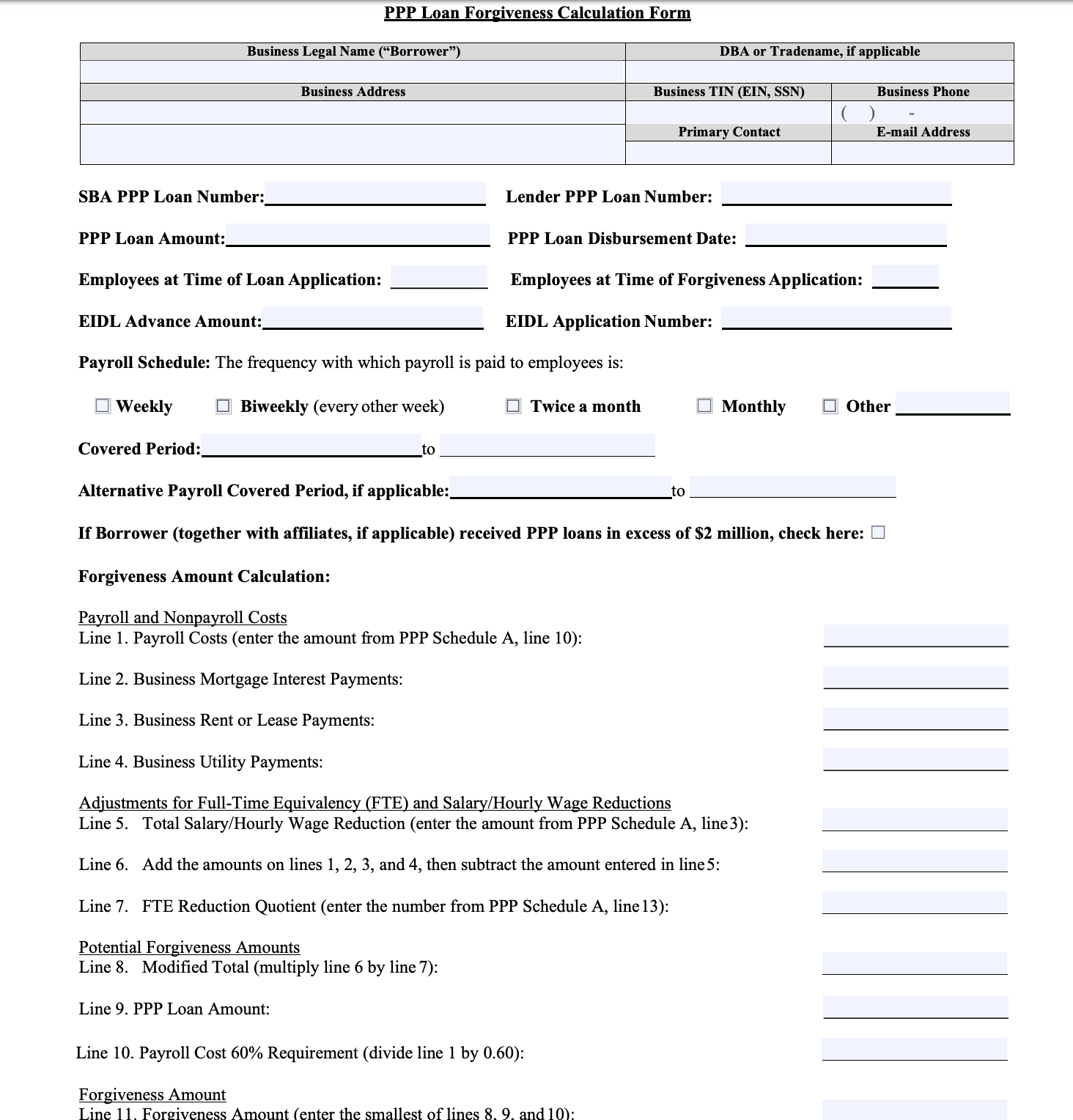

Ppp Loan Forgiveness Application Guide Updated Gusto

.jpg)

Ppp Loan Forgiveness For Sole Proprietors And The Self Employed Hourly Inc

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

Https Www Sba Gov Sites Default Files Resource Files Ppp Loan Forgiveness As Of October 9 2020 Pdf

Ppp Loan Forgiveness Calculator Revised 6 19 20

A Complete Guide To Ppp Loan Forgiveness For The Self Employed Alignable

Ppp Loan Forgiveness Everything You Need To Know Bnc Tax

Ppp Forgiveness Calculation How To Calculate Loan Forgiveness

Self Employed Individuals And Small Businesses Paycheck Protection Program And Loan Forgiveness Smolin

Fast Facts About Ppp Eidl Loan Forgiveness Medows Cpa

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

How To Fill Out Your Ppp Forgiveness Application Form Simplifi Payroll And Hr

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

New Ppp Guidance For The Self Employed Cpa Moms

Ppp Forgiveness Overview And Faqs Business Management Company

How To Track Ppp Loan Expenses For Self Employed Individuals Updated Template Included Youtube

Post a Comment for "How To Calculate Ppp Loan Forgiveness For Self Employed"