Social Security Benefits Worksheet 2019 Calculator

As always none of your inputs are stored or recorded. In 2019 you and your employer would each pay 62 percent of your wages up to the annual maximum of 132900 that you earn for Social Security taxes.

Solved Re Earlier Year Lump Sum Social Security Benefit

This calculator figures your taxable social security benefits based upon the IRSs 2019 Form 1040 2019 Schedule 1 and 2019 Publication 915 Worksheet 1 which was published January 10 2020 and made no substantive changes to the 2018 worksheet calculations.

Social security benefits worksheet 2019 calculator. Do not use this worksheet if any of the following apply. More specifically if your total taxable income wages pensions interest dividends etc plus any tax-exempt income plus half of your Social Security benefits. Enter total annual Social Security SS benefit amount.

If youre self-employed youll need to pay all of the 124 percent Social Security. 2 The taxpayer repaid any benefits in 2019 and total repayments box 4 were more than total. The subject of spousal benefits gets quite complicated depending on.

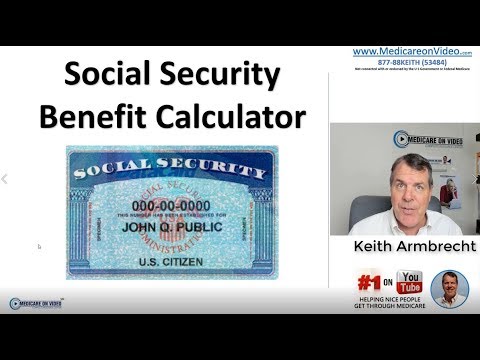

For security the Quick Calculator does not access your earnings record. Use this calculator to compute your Social Security Benefit Adjustment that is reported on CT-1040 Schedule. Box 5 of any SSA-1099 and RRB-1099 Enter taxable income excluding SS benefits.

Many of those who receive Social Security retirement benefits will have to pay income tax on some or all of those payments. Social security benefits tax calculator is in a way concrete answer to often asked question Are social security benefits taxableWell social security benefits are taxable to some people and totally tax free for others as the taxation depends on the computation of total income and other phaseout values which are again dependent on your tax filing status. Calculating 2020 current year SSI amount from a prior year benefit.

Any additional income you earn over 132900 is not subject to Social Security taxes. Meanwhile if you favor to really make it printable youll be able to design and style. Instead it will estimate your earnings based on information you provide.

When you file for Social Security benefits your spouse may be eligible for benefits as well. You can use the money help center calculator to determine how much social security you will get and how income tax may. Worksheet for members who transferred from the Employees.

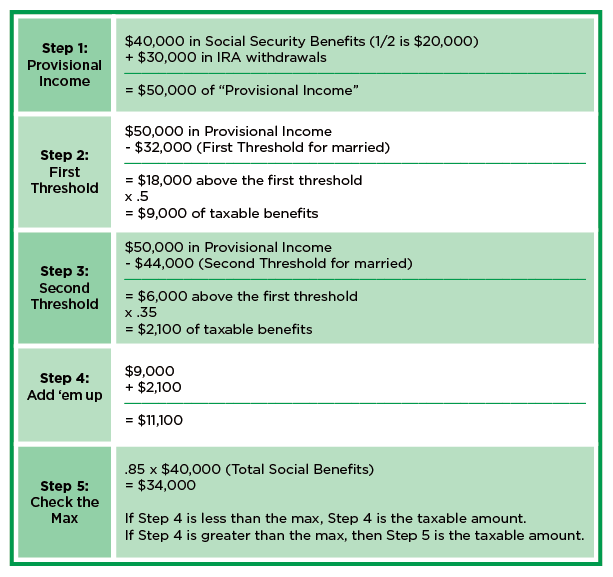

Savings bond interest foreign-earned income or housing. Worksheet to Figure Taxable Social Security Benefits. Benefit estimates depend on your date of birth and on your earnings history.

It then delivers an estimate of your Social Security retirement benefits based on the amount of time you have to save at the rate of income that you earn now. If you encounter this problem download the installation file to your machine as explained in the note above. Social Security Calculation Worksheet a.

Multiplies line a by line b. After you make use of the Digital template you can also make taxable social security benefits worksheet 2019 on Microsoft Excel. Every month taxable social security benefits worksheet 2019 is a straightforward economical supervisor Instrument that may be use either electronic or printable or Google Sheets.

Some people have encountered problems installing the detailed calculator on computers running Windows where the installation file is not allowed to write to the installation directory. The result is the monthly gross. This calculator figures your taxable social security benefits based upon the irss 2018 form 1040 2018 schedule 1 and 2018 publication 915 worksheet 1 which was published january 9 2019 and made no substantive changes to the 2017 worksheet calculations.

Adds lines a and b Results in 2020 gross benefit. So benefit estimates made by the Quick Calculator are rough. The inspiring digital imagery below is part of Social Security Worksheet Calculator article which is categorised within Budget Spreadsheet social security benefits worksheet 2019 calculator social security worksheet calculator excel 2017 social security worksheet calculator and published at July 27th 2021 112833 AM by Reid Ashton.

Highlight Social Security Benefit Calculator and click Remove. This increase in cost results from population aging not because we are living longer but because birth rates dropped from three to two children per woman. Enter below the amounts reported on your 2019 federal Social Security Benefits Worksheet.

Divide line d by line c. Importantly this shortfall is basically stable after 2035. Spousal Benefits Calculator.

Calculating 2020 prior year Social Security income amount from a 2021 benefit. Social Security Benefits Worksheet 2019 Caution. ENTER the net benefit amount of the 2021 monthly benefit.

Currently the Social Security Board of Trustees projects program cost to rise by 2035 so that taxes will be enough to pay for only 75 percent of scheduled benefits. The result is the monthly 2020 SSI income. ENTER the amount of the 2019 SSI monthly benefit a.

ENTER the net benefit amount of the 2020 monthly benefit. Social Security benefits received in FFY21 cannot be calculated from the 2020 monthly benefit because of the inconsistent Medicare Part B premiums and Medicare perscription costs to enrollees. The Social Security Quick Calculator asks for your date of birth and current annual earnings.

This calculator estimates your earnings based on data that you provide. IRS Form 1040 lines 1 2a 2b 3b 4b 4d 5b and 6a and Schedule 1 form 1040 line 9 Enter the total of any exclusion for US. 1 If the taxpayer made a 2019 traditional IRA contribution and was covered or spouse was covered by a qualified retirement plan see IRA Deduction and Taxable Social Security on Page 14-6.

Social Security Benefits WorksheetLines 5a and 5b Keep for Your Records Figure any write-in adjustments to be entered on the dotted line next to Schedule 1 line 36 see the. Press the Calculate Your Social Security Adjustment button when complete 1. Enter the amount reported on your 2019 federal Social Security Benefits Worksheet Line 1.

Taxable Social Security Calculator

Taxable Social Security 2020 Worksheet

Here S The New 2019 Social Security Benefit Formula The Motley Fool

Social Security Calculator When To Start Taking Social Security Youtube

Ssdi Federal Income Tax Nosscr

Ssdi Federal Income Tax Nosscr

/GettyImages-149357059-b06074af5ea4494aba83d73a3755f261.jpg)

How Do I Calculate My Social Security Breakeven Age

How To Calculate Social Security Benefits 3 Easy Steps Youtube

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Taxable Social Security Benefits Worksheet 2020

92 Personal Loan Calculator Page 6 Free To Edit Download Print Cocodoc

2014 2021 Form Irs Instruction 1040 Line 20a 20b Fill Online Printable Fillable Blank Pdffiller

Social Security Benefits Worksheet Social Security Taxable Worksheet Wplandingpages Com Valid Worksheet Template Tips And Reviews

2014 2021 Form Irs Instruction 1040 Line 20a 20b Fill Online Printable Fillable Blank Pdffiller

/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg)

How Much Will I Get In Social Security Benefits

Calculator For 2019 Irs Publication 915 Worksheet 1 Frugalfringe Com

Social Security Benefits Tax Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg)

Post a Comment for "Social Security Benefits Worksheet 2019 Calculator"