Social Security Benefits Worksheet 2020 Instructions

Instructions for Form 1040 and 1040-SR. Social Security account also gives access to the online.

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes

If filing status is MARRIED FILING SEPARATELY follow instruction on Line 4 below 3.

Social security benefits worksheet 2020 instructions. The worksheet in the instruction booklet of the federal form you are filing to determine if any of your Social Security benefits are subject to federal income tax. Do not use this worksheet if any of the following apply. Information about Notice 703 Read This To See If Your Social Security Benefits May Be Taxable including recent updates related forms and instructions on how to file.

Add lines 2 3 and 4 4. If your social security andor SSI supplemental security income benefits were your only source of income for 2020 you probably will not have to file a federal income tax return. Enter the amount reported on your 2020 federal Social Security Benefits Worksheet Line 9.

Line 6 of the worksheet says Enter the total of the amounts from Form 1040 or 1040-SR line 10b Schedule 1 lines 10 through 19 plus any write-in adjustments you entered on the dotted line next to Schedule 1 line 22. Form 1040 Instructions are published later in January to include any last minute legislative changes. Many people wonder how we figure their Social Security retirement benefit.

Benefits and other income the Social Security Benefits Worksheet found in the Form 1040 Instructions is completed by the software to calculate the taxable portion. Enter the taxable amount of Social Security benefits reported on your 2020 federal Social Security. It contains a worksheet to help you figure if any of your benefits are taxable.

Dont mail Notice 703 to either the. When figuring the taxable portion of Social Security benefits two options are available for lump-sum benefit payments. 2019 Tax Year Premium Quickfinder HandbookReplacement Page 12020 3-11 Social Security Benefits Worksheet 2019 Caution.

501 Dependents Standard Deduction and Filing Information or your tax return instructions to find out if you have to file a return. Form SSA-1099 Social Security Benefit Statement 2020. Every person who received social security benefits will receive a Form SSA-1099.

If a or b applies see the instructions for lines 6a and 6b to figure the taxable part of social security benefits. More specifically if your total taxable income wages pensions interest dividends etc plus any tax-exempt income plus half of your Social Security benefits. Many of those who receive Social Security retirement benefits will have to pay income tax on some or all of those payments.

Enter the amount reported on your federal 2017 federal Social Security Benefits Worksheet Line 1. Enter the amount reported on your 2017 federal Social Security Benefits Worksheet Line 9. Provides estimates of retirement benefits at three ages.

The taxpayer may report the whole payment in the year it was received or treat the payment as. Social Security Number SSN Dependents Qualifying Child for Child Tax Credit and Credit for Other Dependents. Standard Deduction Worksheet for Dependents Line 12 Student Loan Interest Deduction Worksheet.

Figure any write-in adjustments to be entered on the dotted line next to Schedule 1 line 36 see the instructions for Schedule 1 line 36. Go to page 31 Social Security Benefits Worksheet. There are different worksheets for calculating taxable Social Security benefits for certain situations.

IRS Notice 703 will be enclosed with this form. Keep for Your Records. Social Security Benefits WorksheetLines 5a and 5b.

Form 1040 is generally published in December of each year by the IRS. Social security benefits worksheet - Learning regarding the particular value of cash is among the primary lessons kids of today can learn. Total Income and Adjusted Gross Income.

Worksheet to Figure Taxable Social Security Benefits. You may not use the worksheet in the instructions to. Social Security Benefits Worksheet.

There is a Social Security Benefits Worksheet on page 30 of the 2020 IRS instructions for Form 1040 but on page 27 in the right column there is a list of situations in which you cannot use that worksheet. 1 If the taxpayer made a 2019 traditional IRA contribution and was covered or spouse was covered by a qualified retirement plan. Complete this worksheet to see if any of your social security andor SSI supplemental security income benefits.

Social Security Benefits WorksheetLines 20a and 20b Keep for Your Records 1. Line Instructions for Forms 1040 and 1040-SR. If you receive benefits on more than one social security record you may get more than one Form SSA-1099.

If you determined that any part of your benefits is taxable you must use federal Form 1040 or federal Form 1040-SR. We developed this worksheet for you to see if your benefits may be taxable for 2020. They are able to draw an auto dvd unit of.

Enter the taxable amount of Social Security benefits reported on your 2017 federal Social Security. Age 62 full retirement age and age 70. We base Social Security benefits on your lifetime earnings.

Enter the total amount from box 5 of all your Forms SSA-1099 and RRB-1099 Add the amounts on Form 1040 lines 7 8a 9 through 14 15b 16b 17 through 19 and 21. Most drastically you have to love them and you have to have the present of teaching. Enter the amount reported on your 2020 federal Social Security Benefits Worksheet Line 1.

If you are married filing separately and you lived apart from your spouse for all of 2018 enter D to. Simplified Method Worksheet. If filing status is MARRIED FILING SEPARATELY follow instruction on Line 4 below 3.

Dont include any social security benefits unless a you are married filing a separate return and you lived with your spouse at any time in 2020 or b one-half of your social security benefits plus your other gross income and any tax-exempt interest is more than 25000 32000 if married filing jointly. Do not include amounts from box 5 of Forms SSA-1099 or RRB-1099 3.

Https Assets Ctfassets Net Lrqh3qmw9nn5 350arrdd8y2jk2mfmvnfrs D7782ef6fa57b13605a53528fe93f197 Elizabeth Warren 2020 Tax Return Pdf

Tax Forms Irs Tax Forms Capital Gain

12 Rules For Life Worksheets Workbook For Jordan B Etsy In 2021 Life Rules Workbook Life

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Iras Internal Revenue Servic Irs Tax Forms Social Security Benefits Irs Taxes

2015 Irs W9 Form Top 22 W 9 Form Templates Free To In Pdf Format Fillable Forms Blank Form Templates

What Is Form W 2 W2 Forms Irs Tax Forms Tax Forms

Funeral Planning Checklist Template Fresh 5 Funeral Planning Checklist Template Sampl Funeral Planning Checklist Funeral Planning Simple Business Plan Template

This Annuity Calculator Helps You Perform Calculations Related To Your Annuity Payments After Retirement Incl In 2020 Annuity Calculator Annuity Retirement Calculator

Pin By Lance Burton On Unlock Payroll Template Money Template Money Worksheets

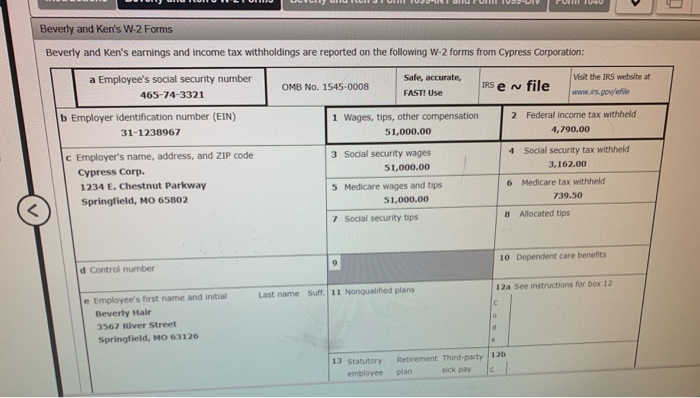

Instructions Comprehensive Problem 2 1 Beverly And Chegg Com

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet Irs Tax Forms Irs Taxes Irs Forms

In A Comment Letter Sent June 13 2019 Roger Harris Expressed Concern That The New Requirements Placed On Employers P Federal Income Tax Lettering Employment

Us Federal Income Tax Forms 3 Five Things You Probably Didn T Know About Us Federal Income T In 2021 Income Tax Income Tax Return Federal Income Tax

A Sole Proprietor Reports The Sole Proprietorship Income And Or Losses And Expenses By Filling Out And Filing A Schedule C A Irs Tax Forms Irs Taxes Irs Forms

116 Visual Content Ideas For Your Biz Build A Little Biz Blog Marketing Strategy Infographic Marketing Strategy Social Media Strategy Infographic

2005 Form Irs Publication 915 Fill Online Printable Fillable Blank Pdffiller

Post a Comment for "Social Security Benefits Worksheet 2020 Instructions"